Dalmia Refractories

The Refractory business of over sixty years of experienced Dalmia Bharat Group comprises two specialty companies – OCL Refractories and Dalmia Refractories Limited. Refractory products are used in high-temperature processes that go into the making of metals, cement, glass and ceramics. Established in 1954 as a unit of OCL India, OCL Refractories is a leading refractory supplier to domestic and international steel plants.

Set up in 1959, Dalmia Refractories (previously Shri Nataraj Ceramics and Chemical Industries Ltd) is a pioneer in high alumina refractory bricks for the Indian cement, steel industry. Manufacture & sale of Refractories, Castables and Mortars contribute 93% of total turnover of the Company.

Refractory business has four manufacturing plants in India, one in China, a Technology Center and sales representatives at strategic locations around the world. The business provides a wide range of refractory products and services to both ferrous and non-ferrous plants, including Iron & Steel, Cement, Glass, Copper and Hydrocarbons. Apart from India, company is also focusing on West Asia, Africa and Russia for better capacity utilization.

Dalmia Refractories hold 3,49,476 shares of Dalmia Bharat (0.39% holding) and 1000 shares of Dalmia Bharat Sugar and Industries (as per corporate announcement filed for Mar 31, 2018, total valued over Rs. 100 Crs.

Exports currently account for nearly 15 per cent (or over ₹80 crore) of its ₹550 crore refractory business. The plan is to double it over the next one to two years he further concluded. Higher exports will lead to better capacity utilisation. The capacity utilisation for the refractory industry as a whole has been close to 50-55 per cent.

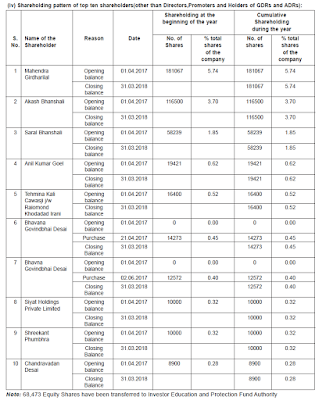

Shareholding Pattern:

Promoters holds 64.83% comprising. Banks and Financial Institutions holds 0.04%. Mahendra Girdharilal holds 5.74% and Vallabh Bhansali son (Akash & Saral) holds 5.55%. Below are the top ten shareholders.

Joint Venture

Europe based Seven Refractories, one of the largest and most advanced portfolio of monolithic refractory materials, complemented by project management and exhaustive modern installation knowledge has entered into an agreement in 2017 with the refractory business of Dalmia Bharat Group to develop and supply a wide range of monolithic refractories for the Indian market. Seven serves over 300 customers in 40 different countries.

The joint venture entity – Dalmia Seven – will upgrade and modernise Dalmia’s existing factory at Katni in Madhya Pradesh at an estimated investment of close to ₹32 crore ($5 million). Dalmia has a 51 per cent stake in the joint venture company. According to Sameer Nagpal, CEO-Refractories, a new line will be put up at the plant at Katni to manufacture value added and premium range of monolithic refractory products. The new line will be operational by the end of the calendar year 2018.

Industry Overview & Outlook

Steel, Power, and Cement Companies are primary consumers of Refractories. Global Refractories Market demand is witnessing a steady growth owing to rising demand of high performance refractories along with the increasing production of steel, cement, and glass materials across the globe. Among the aforementioned types, steel & iron is the most dominating end-use industry accounting for more than 70% of the overall consumption. The consolidation in steel & cement industry is likely to gain pace with the takeover of financially weak companies by the strong players with advent of the Insolvency and Bankruptcy Code enacted in India. This is likely to lead to increase in capacity utilization and consequently increase in refractory demands.

Asia-Pacific has the highest share in the market, accounting for nearly 59% of the global market share in 2017. The large consumer base and the cheaper manufacturing costs in the Asia-Pacific region are drawing in high FDIs, with India and China being the major players. Long term outlook for cement industry to which company mainly cater is likely to be relatively more favorable given the government’s focus on revival of infrastructure and investment spending. The pace of recovery in the steel & cement industry is likely to mirror the trends in economic recovery.

Financial Overview

The Company has been able to achieve a revenue of Rs. 178.64 Crs. as against previous year revenue of Rs. 160.76 Crs. It has incurred a loss of Rs. 5.61 Crs. as against the loss of Rs. 0.28 Crs. in the previous year, due to significant increase in the cost of raw material and power & fuel and its inability to pass on the same to the customers.

Final dividend of Rs. 0.50/- per equity share of face value of Rs. 10/- each for the financial year 2017-18.

Final Words

The Government taking steps in several areas including amendments in policy legislation and with likely increase on infrastructure expenditure, refractory installation activity is expected to pick up thereby leading to better growth prospects for the Refractory Industry. With the latest monolithic refractory technology, customized and advanced solutions, committed to faster deliveries, a complete refractory solution provider and localized services to Indian industry, Dalmia Refractories outlook is rosier and committed to the progressive evolution.

Dalmia Refractories which was earlier Listed in Madras Stock Exchange is at present , defacto, Delisted ( although officially listed in Metropolitan Stock Exchange and CSE). To buy or sell the shares of Dalmia Refractories, you can connect to me at +91 9820900224 or email me at deepa.bhatia14@gmail.com

Feel free to get in touch - deepa.bhatia14@gmail.com / +91 9820900224

1) To understand or share the growth stories in unlisted space.

2) To accumulate or liquidate unquoted shares

3) To understand the eligibility criteria of listing on BSE / NSE / MSEI or on SME platform

4) To get your company listed on the Stock Exchange

5) To arrange an investors for your company

5) To arrange an investors for your company

Comments

Post a Comment