Polycab

About the Company

We are engaged in the business of manufacturing and selling wires and cables and fast moving electrical goods (“FMEG”) under the “POLYCAB” brand. According to CRISIL Research, we are the largest manufacturer in the wires and cables industry in India, in terms of revenue from the wires and cables segment and provide one of the most extensive range of wires and cables in India. For Fiscal 2018, we have a market share of approximately 18% of the organized wires and cables industry and approximately 12% of the total wires and cables industry in India, estimated at ₹525 billion based on manufacturers realization (Source: CRISIL Research).

Apart from wires and cables, we manufacture and sell FMEG such as electric fans, LED lighting and luminaires, switches and switchgears, solar products and conduits and accessories. According to CRISIL Research, the wires and cables industry in India, in value terms, has grown at a compound annual growth rate (“CAGR”) of approximately 11% in the last five years to reach ₹525 billion in Fiscal 2018. CRISIL Research expects the wires and cables industry in India to expand at a CAGR of approximately 15% in value terms to reach approximately ₹1,033 billion by Fiscal 2023.

We manufacture and sell a diverse range of wires and cables and our key products in the wires and cables segment are power cables, control cables, instrumentation cables, solar cables, building wires, flexible cables, flexible/single multi core cables, communication cables and others including welding cables, submersible flat and round cables, rubber cables, overhead conductors, railway signaling cables, specialty cables and green wires. In 2009, we diversified into the engineering, procurement and construction (“EPC”) business, which includes the design, engineering, supply, execution and commissioning of power distribution and rural electrification projects. In 2014, we diversified into the FMEG segment and our key FMEG are electric fans, LED lighting and luminaires, switches and switchgears, solar products and conduits and accessories. We have 24 manufacturing facilities, including our two joint ventures.

We have an established supply chain comprising our network of authorized dealers, distributors and retailers. This network supplies our products across India. Our distribution network in India comprised over 2,800 authorized dealers and distributors and 30 warehouses as at and for the nine months period ended December 31, 2018. We supply our products directly to our authorized dealers and distributors who in turn supply our products to over 100,000 retail outlets in India.

Financials

From Fiscals 2016 to 2018, our total income less excise duty grew at a CAGR of 14.31%. During the same period, Fiscals 2016 to 2018, our EBITDA and profit for the year grew at a CAGR of 23.82% and 41.71%, respectively. For Fiscals 2016, 2017 and 2018, our total income less excise duty was ₹52,355.47 million, 55,756.49 million and ₹68,414.91 million respectively, our EBITDA margin was 10.01%, 9.96% and 11.74% respectively, our PAT margin was 3.53%, 4.18% and 5.42% respectively, our ROE was 10.34%, 11.67% and 15.76% respectively, our RoCE was 15.99%, 14.98% and 21.25% respectively, and our debt to equity ratio was 0.45, 0.43 and 0.34 respectively.

From the nine month period ended December 31, 2017, our total income less excise duty, EBITDA and profit for the period ended December 31, 2018 grew by 17.48%, 69.81% and 97.94%, respectively. For the nine month periods ended December 31, 2017 and December 31, 2018, our total income less excise duty was ₹47,335.84 million and ₹55,610.52 million respectively, our EBITDA margin was 9.25% and 13.37% respectively, our PAT margin was 3.82% and 6.44% respectively, our ROE was 8.31% and 13.16% respectively, our RoCE was 9.88% and 19.04% respectively, and as at December 31, 2017 and December 31, 2018 our debt to equity ratio was 0.57 and 0.23 respectively.

Fresh Issue

The Net Proceeds from the Fresh Issue are proposed to be utilised towards the following objects:

1. Scheduled repayment of all or a portion of certain borrowings availed by our Company;

2. To fund incremental working capital requirements of the Company; and

3. General corporate purposes.

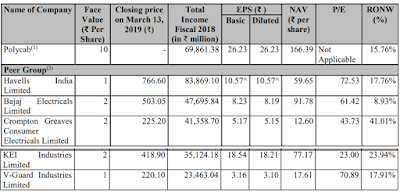

Peers

In the cables and wires segment, Polycab India Limited is the largest player with segment revenues to the tune of Rs 62.4 billion as of fiscal 2018 among peers like Apar Industries Ltd, Finolex Cables Ltd, Havells India, KEC International, KEI Industries Ltd, R R Kabel Ltd and V-Guard Industries Ltd. As of fiscal 2018 Polycab India Limited enjoys ~18% market share of the organised cables and wires industry, estimated at Rs 346 billion, and ~12% market share of the total cables and wires industry, estimated at Rs 525 billion based on manufacturers realisations.

In the electrical consumer durables category, Havells India Ltd is the largest player among the peers listed above, with segmental revenues of Rs 41.7 billion as of fiscal 2018. At a segment level, electrical consumer durables revenues of players like Polycab India Limited and Finolex Cables Ltd have grown at CAGR of 58% and 24% respectively, albeit from a low base, during the fiscals 2016 to 2018. Electrical consumer durables category broadly includes National Industrial Classification (“NIC”) codes such as 2740 and 2750 as per NIC 2008 update. CRISIL Research has classified electrical consumer durables into fans, lightings and luminaries (domestic and commercial), water heaters, switches and switchgears, kitchen appliances such as mixer grinders, food processors, cooking tops, coffee makers, and juicers, and home appliances such as iron, air cooler, room heaters and stabilizer.

Among the players listed above, the operating revenues of KEI Industries Ltd and Polycab India Limited have grown at a faster clip at CAGR 20.8% and 14.2% respectively, during fiscals 2014 to 2018. At a segment level, cables and wires revenues of players like Apar Industries Ltd, KEI Industries Ltd and Polycab India Limited have grown at CAGR of 19.4%, 11.7% and 11.9% respectively during the corresponding period. (Note: Gupta Power Infrastructure Ltd has not been considered in this set as financials for fiscal 2018 are not available)

Among the players listed above, the operating profits before depreciation, interest and taxes (“OPBDIT”) for Bajaj Electricals Ltd and Polycab India Limited have grown at a faster clip at CAGR 43.4% and 25.5% respectively, during fiscals 2014 to 2018. Operating margins (OPBDIT/ operating revenue) for Bajaj Electricals Ltd have increased from 2.0% in fiscal 2014 to 7.3% in fiscal 2018, similarly operating margins for Polycab India Limited have increased from

7.5% in fiscal 2014 to 10.9% in fiscal 2018.

Among the players listed above, Orient Electric Ltd, Finolex Cables Ltd. and Polycab India Limited enjoy an extensive distribution network of 4,000+, 3,500+ and 3,372 distributors and dealers as of fiscal 2018. With regards to retail touch-points, Surya Roshni Ltd leads the peer set listed above with 2,00,000 retailers, followed by Bajaj Electricals Ltd with ~160,000 retail outlets and Crompton Greaves Consumer Electricals Ltd at 150,000+ retail outlets as of fiscal 2018.

In absolute terms, Havells India Ltd incurred Rs 3.5 billion as expenses towards advertising and sales promotion, which comprises ~4.2% of its operating revenues as of fiscal 2018. In terms of share of operating revenue, TTK Prestige Ltd’s spend towards advertising and sales promotion was 7.5% as of fiscal 2018. Players like Polycab India Limited have increased their spending on advertising and sales promotion at 54.7% CAGR from 0.4% of operating revenues in fiscal 2014 to 1.4% operating revenue in fiscal 2018.

Polycab IPO Dates & Price Band:

IPO Open: 05-April-2019

IPO Close: 09-April-2019

IPO Size: Approx ₹1346 Crore

Face Value: ₹10 Per Equity Share

Price Band: ₹533 to ₹538 Per Share

Listing on: BSE & NSE

Retail Portion: 35%

Equity: 17,582,000 Shares

Polycab IPO Market Lot:

Shares: Apply for 27 Shares (Minimum Lot Size)

Amount: ₹14,526

Polycab IPO Allotment & Listing:

Basis of Allotment: 12-April-2019

Refunds: 15-April-2019

Credit to demat accounts: 16-April-2019

Listing: 18-April-2019

For Application Forms: Join Below Whatsapp Group

Comments

Post a Comment